What is FOMO in Trading?

When it comes to making investment decisions in today’s financial markets, emotions frequently play a crucial role. One such feeling that has a big effect on traders is “FOMO,” or the fear of missing out. Understanding FOMO is essential for making thoughtful and logical decisions, regardless of experience level in the stock market.

FOMO is now a common term among traders all over the world, and it transcends the boundaries of social gatherings and popular events. Based on our practical assessments, we may conclude that FOMO in trading refers to the fear of missing out on a potentially profitable opportunity or shift in the market. The purpose of this blog article is to explain the idea of FOMO trading by examining its history, psychological foundations, and—most importantly—, its possible influence on financial choices.

What is FOMO in Trading Strategy?

- The fear of missing out, or FOMO, is a prevalent psychological phenomenon in trading that permeates the industry. FOMO, as used in trading terminology, describes the uneasiness or fear traders experience when they think they could lose out on a potentially lucrative trading opportunity. This concern is frequently brought on by seeing other people make profitable trades, seeing abrupt changes in the market, or learning about a “hot tip” that offers large profits.

- Trading decisions may be significantly impacted by FOMO. When experiencing fear of missing out on opportunities, traders could be more likely to act rashly and impulsively, departing from their well thought out plans. This anxiety may cause one to chase the market, invest in an asset at a premium, or give in to the temptation of generating rapid profits.

Understanding Behavioral Finance and FOMO in Investing

- Behavioral finance is a term used in the finance industry to explain how social influences and feelings can impact investment decisions. This method acknowledges that people occasionally may follow the herd rather than depending only on reason, particularly when attempting to ward off FOMO (fear of missing out).

- When it comes to FOMO in investing, people may forgo thorough consideration and reasoned reasoning in favor of following the crowd and making snap decisions. The results of investments may be significantly impacted by this switch to emotional decision-making.

- In this case, social media is quite important. On sites like Reddit and Twitter, stock market rumors can circulate quickly, and a lot of investors look to these sources for inspiration when making investing decisions. Over-reliance on social media, however, might exacerbate the pressure to succumb to FOMO and make investments that aren’t in line with a well-considered plan.

The Characteristics of a FOMO Trader

The fear of missing out, or FOMO, has a big impact on trading decisions. Traders prone to FOMO display distinct traits that set them apart in the financial markets. The following are essential characteristics of a FOMO trader:

- Overtrading: Excessive trading activity might be caused by the fear of missing out. FOMO traders may move quickly in and out of positions in an effort to profit from every shift in the market, even if it deviates from their original strategy.

- Reactive Decision-Making: FOMO traders frequently respond rapidly to news about the market, social media fads, or other traders’ moves. They might not take the time to double-check facts or think through the possible consequences of acting on impulse.

- FOMO, or the fear of being left behind while others benefit, is at its foundation. This anxiety can impair judgment and cause traders to base their decisions not on their own analysis but rather on what other traders are doing.

- Challenges Following a Plan: FOMO traders frequently find it difficult to follow a set trading strategy. They can stray from their plan out of a fear of losing out on a perceived opportunity, which would increase the chance of losing.

- FOMO traders have a tendency to act based on their emotions, especially excitement and worry. Making decisions based on emotions might lead to unpredictable trading patterns and less than ideal results.

Strategies to Avoid FOMO Trading

Plan Your Investments

- Having a well-defined plan is essential for sensible investing, as opposed to succumbing to FOMO (the fear of missing out). Doing extensive research on the companies you are interested in is the first step towards developing a sound plan. This entails being aware of their market position, development potential, and financial stability. By understanding how to value companies using techniques like price-to-earnings ratios and discounted cash flow, you may make well-informed judgments based on a stock’s true value rather than just market trends.

- Determining your personal risk tolerance is essential to making choices that support your financial objectives. By doing this, you can avoid having strong emotional responses to market fluctuations while simultaneously constructing a more diversified portfolio. By abstaining from snap decisions and adhering to a carefully considered plan,

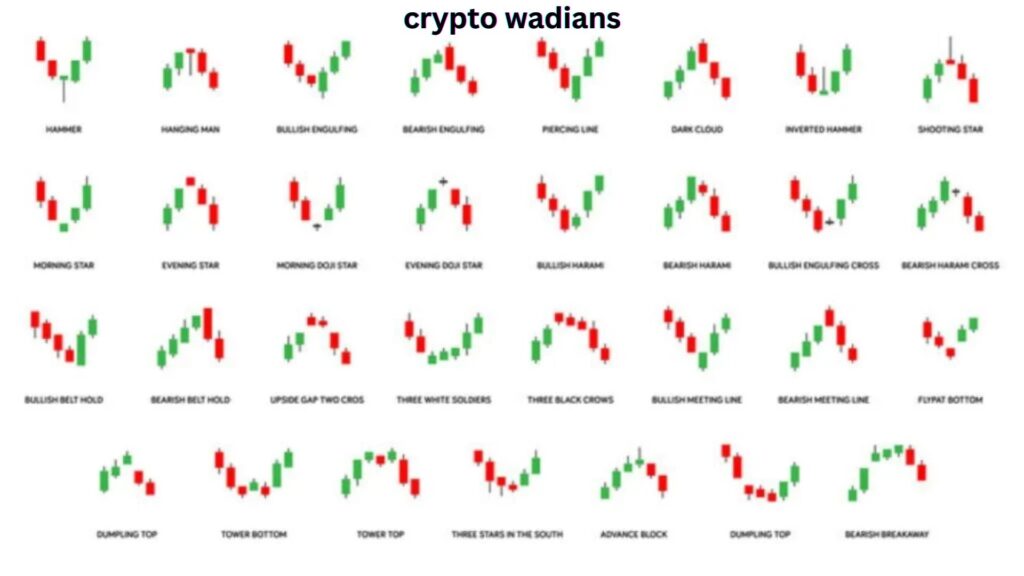

Technical Analysis to Help Make Wise Trading Selections

- An essential component of wise trading strategies is technical analysis. Your plan should direct you on important facets of price movement, pointing out regions to stay out of and pointing out possible resistance or reversal zones. It is imperative to exercise caution and refrain from entering into deals that are inside these designated ranges.

- During the testing process, we observed firsthand that day trading indicators are essential for validating or invalidating trades. It’s critical to believe in these indicators, and it makes sense to follow their counsel if they warn against making a deal. Realizing that the market has access to more knowledge than any one trader does is a critical component of humility in trading.

Maintain Your calmness

It’s critical to maintain composure when faced with swift shifts in the market. Fast-moving markets are often the setting for impulsive trades. Remain true to your plan rather than allowing your feelings influence your choices when navigating unpredictable markets.

Take into consideration adding a trading log to your daily regimen. It’s helpful to keep a journal of your trades, noting the reasoning behind each choice and the feelings you felt. With time, you can improve your strategy by identifying trends in your behavior with the aid of this easy activity.

Recall that your entire financial portfolio is rarely defined by a single stock trade. When you see an enticing “can’t-miss” stock and are tempted to purchase it, remember that there will always be better alternatives.

Proper Risk Management Plan

It’s still true that you should never gamble with money you can’t afford to lose. It is never a wise decision to chase a stock that has substantial market value and that your portfolio cannot afford to be without. Generally speaking, you should be patient and wait for a better opportunity when the risk of an investment is too great and it could have a large enough influence on your portfolio.

Don’t Trust Every Social Media Advice

While social media can be a great source of information for investors in the market, it’s important to distinguish it from a solid investing plan. Whether they are touts, short sellers, penny stock aficionados, or other individuals with their own interests in mind—which may not coincide with yours—these platforms are frequently populated with other traders pushing stocks. As a general rule, social media promoters tend to highlight their successes while downplaying their setbacks.